By The Wise Marketer Staff

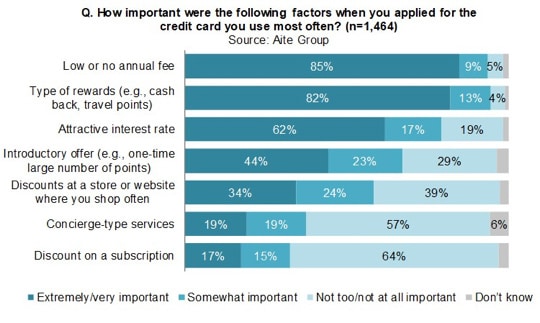

A new research report from the Aite Group highlights the growing importance of rewards programs when it comes to US consumer preference for choosing a credit card. Traditionally these preferences were dominated by annual fee and interest rate issues but in recent years rewards has moved up the list and now occupies the #2 position, almost equal to the desire for a low or no annual fee. Additionally, the practice of offering a large, one-time points bonus for applying has gained significance and now ranks 4th on the list.

Key quote from Aite Group Analyst, Kevin Morrison, who authored the report:

“A rewards card offering is a key weapon in U.S. banks’ arsenal. The challenges are providing compelling offers that will attract and retain consumers profitably and balancing the competing priorities of the financial institution and its partners. With loss provisions increasing over the last two quarters and default levels beginning to rise, maintaining profitable rewards card portfolios that meet the needs of the consumer, the FI, and the partner will be crucial.”

US credit card holders know the loyalty game, play it very well and continue to seek out value in the form of an issuers reward offerings. Any issuer who fails to stay competitive in this arena will likely suffer churn in their portfolio. More importantly, any issuer who can step up his game and innovate in the rewards competition will likely gain share and financial benefit. Who’s ready?