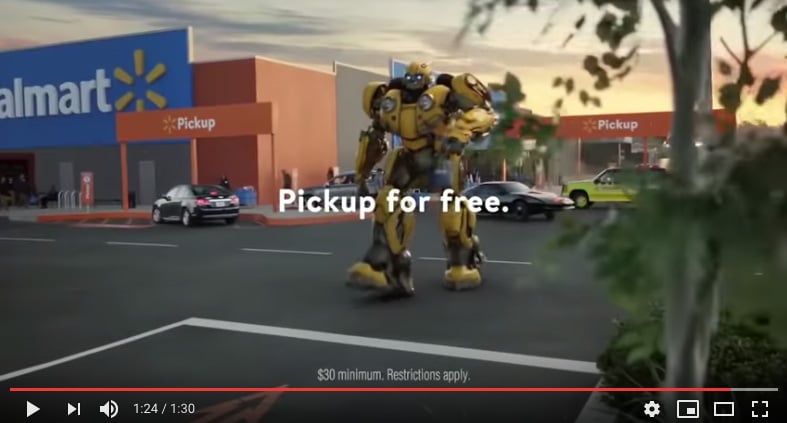

The almost ubiquitous spots featuring cameos from a roster of movie-famous cars, trucks, and Transformers have all but filled the morning and evening dayparts of many TV networks. The commercials are already approaching annoying status but apparently, they’re having the desired effect.

Walmart’s most recent earnings call all but destroyed analysts’ forecasts. U.S. same store sales were up 4.2% and the average shopper’s ticket grew 3.3%. Revenue climbed almost 2 full points over a year ago to $138.79 billion and net income for the most recent quarter reported came in at 3.69 billion, or $1.27 per share.

All of this tells a healthy story but the most remarkable statistic may be this one: e-commerce sales in the U.S. jumped 43% year-over-year during the quarter. Pause here for dramatic effect – yes, 43% YoY for a large, mature e-commerce company. Not so bad.

But what’s behind the impressive numbers? “Retailers watching Walmart’s success must understand that its impressive Q4 earnings results were driven in large part by its significant investment in ecommerce,” noted Sylvain Perrier, president and CEO of Toronto-based Mercatus, a digital solutions provider for grocery. “This includes various grocery initiatives such as online ordering, BOPIS and delivery. While some have been hesitant to drive these efforts within their organizations, Walmart is proof that shoppers welcome these initiatives. However, this didn’t happen overnight for Walmart – it required thoughtful investment, planning and data analysis to ensure a successful execution. Yet you don’t need to be a mega-retailer to do the same. Regional retailers can learn from Walmart and take the steps necessary to offer their customers more convenience and personalization in grocery in order to improve customer satisfaction, loyalty, and ultimately, as Walmart has shown us, the bottom line.”

BOPIS is now a thing. And customer loyalty practitioners would do well to consider that this is not just a new service method but an entirely new channel. According to Retail TouchPoints, "Retailers are accelerating the move to "phygital" — the digitization of the in-store experience. By 2021, 90% of retailers will offer Buy Online/Pick Up In-Store (BOPIS)."

So, this begs a few questions and provokes a few thoughts:

Thought: Maybe Amazon isn’t eating everyone’s lunch after all.

Thought: Certain categories will certainly emerge as more BOPIS-worthy than others. We can surmise now which ones will win, but the curve to some sort of BOPIS maturity will likely be rather short.

Thought: If 90% of retailers are going to be offering BOPIS services within 2 short years, loyalty professionals should be thinking about integrating & leveraging this new channel NOW.

What're your thoughts on BOPIS?

We invite your thoughts and questions as well. BOPIS is clearly a huge opportunity for retailers that have the wherewithal to implement it well. But, as we’ve already heard, coordinating and online sale with an offline pickup can present big challenges. Let’s think about this together.

Mike Giambattista is Editor in Chief at The Wise Marketer and is a Certified Loyalty Marketing Professional (CLMP).