The news of Amazon’s big move into the pharmacy business caught our attention. Predictions about the impact of the impending disruption of yet another brick and mortar retail segment by the massive online retailer is a story we can write another day. What really jumped out to us was the news that immediately upon announcement of Amazon’s acquisition of Pillpack.com, the stock market punished the share prices of both CVS (down 6.6 percent) and Walgreens (down more than 9 percent) in the same market session.

By Bill Hanifin, CLMP

Market analysts are jumping to several conclusions as they run in fear from the shares of both CVS and Walgreens. First, they are assuming that price competition and supply chain management, core aspects of Amazon’s successful business model, will create a long-term advantage for Amazon/Pillpack versus traditional pharmacy competitors. Next, they are immediately convinced that Amazon’s presence in the pharmacy business will have tangible impact on consumer behavior. In other words, they are expecting that the percentage of consumers who choose to purchase prescription drugs online will significantly increase just because Amazon is the newest pharmacy of choice.

The one thing that stock analysts seem to ignore, or just heavily discount, is the importance of customer shopping experiences and customer loyalty in driving and maintaining market share. All of this compelled us to take stock of the respective customer loyalty programs offered by CVS and Walgreens. How do the two programs compare and is either, or both, strong enough to influence customers to continue to shop in their stores, rather than fleeing for their keyboards to order prescriptions and other over-the-counter items?

The receipt:

If you believe that size matters, then CVS is the clear winner. We resist floating more humor about the length of their receipts, because we happen to know that CVS executives are well-aware their receipts are the butt of many jokes and, we understand, are on their way to making changes. For consumers committed to green causes and wondering “there must be a better way” to communicate offers, transforming the lengthy receipts to a digital format could relieve angst about paper waste and unlock higher engagement

The flip side of the receipt debate is that, while the CVS receipt is long, it is at least communicating offers to its ExtraCare members. There is a benefit to the immediacy of the customer watching the receipt print at the point-of-sale and hearing the cashier comment “wow, you’ve got lots of deals”. The Easter-egg hunt that follows can be fun for consumers, especially when a $5 ExtraCare bucks slip is found in the process.

Have a look at a typical Walgreens receipt and it is void of promotional impact. Walgreens elects to use the purchase receipt to communicate program standing by sharing points earned in the transaction, point balance totals, and points needed to reach the next reward. It is difficult to say just how Walgreens promotes Balance Rewards in its stores. There is a prompt on the payment terminal asking if the customer is a program member, but the pharmacy misses out on the opportunity to promote the manufacturer-driven coupons that make the CVS receipt so weighty.

The Earn:

CVS clearly states that ExtraCare members earn 2% back on purchases. This is part of the receipt verbiage and is accompanied by status updates on club purchases that range across Hallmark Cards, Hair Color products, and soft drinks. The impact of the rewards message is weakened however by leading off with a “year to date savings” message. While it feels good on the surface to see a healthy savings total, it is not clear how the number is calculated. Even more fundamental, do consumers believe that such a number is really “savings”, or like the grocery receipts which cheerily shout that “you’ve saved $x.xx today”, just the result of sale prices which they should have earned anyway?

The earning value in the Walgreens program requires just a bit more work to decipher. I had to login to the member website to clearly understand that members earn 10 points per dollar and that 1,000 points equaled $1.00 in rewards value. In plain language, Walgreens rebates 1% to Balance Rewards members on purchases, while CVS rebates at 2%.

Walgreens does factor in a higher rebate for Balance Reward Members who choose to accumulate points over time. Members who collect 18,000 points earn 1.1% and can earn as much as 1.3% if they reach a 40,000 total. The concept is a good one, but Balance Rewards stretches out the earning curve much too long.

If the average member spends $100/month, it would take almost 3 ½ years to accumulate 40,000 points. Our assumption on monthly spend could be wrong here but considering that pharmacy is not an aspirational part of consumer’s monthly spending, value in the program should be delivered at a much earlier stage.

If the average member spends $100/month, it would take almost 3 ½ years to accumulate 40,000 points. Our assumption on monthly spend could be wrong here but considering that pharmacy is not an aspirational part of consumer’s monthly spending, value in the program should be delivered at a much earlier stage.

Digital Communication:

Both CVS and Walgreens have the point-of-sale, mobile apps, and websites at their disposal to communicate the value of their programs and to deliver offers.

CVS elects to position kiosks in its stores where members can swipe a card or scan a bar code from its app to learn about offers available on that shopping trip. There is also an option to have the offers earned on the receipt to be loaded onto the member “card” or account, making them automatically eligible for use upon the next purchase transaction.

Outside of scanning the app at the kiosk on each store visit, it seems the CVS program places greater value on interaction at the point-of-sale, with the impact of those lengthy receipts counted on to bounce customers back into the store as quickly as possible.

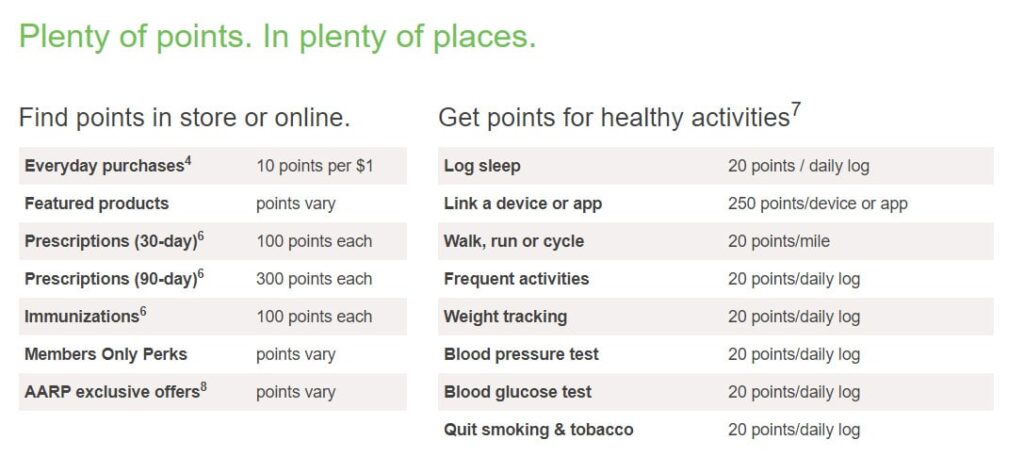

Walgreens also relies heavily on the point-of-sale, with prompting at the card terminal, but fails to fully communicate the many ways that members can earn points. Have a look at the graphic below or click this link and you will see that Walgreens offers different earn rates on everyday purchases and prescriptions.

You will also see the biggest differentiator that Walgreens Balance Rewards has to offer in competition with CVS, an array of point earning opportunities for tracking positive behaviors that contribute to a healthy lifestyle. This element of the Balance Rewards program was one of the most innovative aspects of the program when launched and reinforced the Walgreens brand tagline “at the corner of happy and healthy” which the company ditched at the end of 2017 in favor of “Trusted since 1901”.

Is the suppression of the healthy living benefits in Balance Rewards related to the shift in brand messaging? We can’t answer that question but can say that a differentiating aspect of the rewards program seems to be underutilized.

The Data:

CVS is clearly striving to evidence that it is observing the purchasing patterns of its members by returning manufacturer coupons related to items they have purchased as well as others that might be of interest. Considering the length of the receipt, it has been surprising to note that only a small percentage of coupons printed are related to past purchases. Looking on the member website, however, coupons are categorized based on past purchases and other groupings, so the use of transactional data to trigger specific offers is much clearer.

How Walgreens is using its member purchase data is not as clear. As we’ve mentioned, the receipt is not used for promotional purposes and the point-of-sale terminal is only useful to identify members with their transactions. A scan of member emails over the past several months does not put product related offers in the spotlight. We are sure that Walgreens is carefully tracking member purchase data but wonder why the insights from this data are not more clearly made evident to improve the perception of value with Balance Rewards.

Conclusion – do we have a winner?

CVS ExtraCare would seem to have an edge in this head-to-head competition. The pharmacy keeps the value of ExtraCare squarely in front of its members at the point-of-sale and actively serves up a large volume of manufacturer coupons. It also delivers twice the rebate at a base level, while Walgreens is allowing its differentiating set of lifestyle rewards to slip further into the fine print of its program benefits.

The bigger question is whether either program packs the punch to serve as an Amazon/Pillpack vaccine. In both cases, the communication of program benefits could be sharpened to heighten the perceived value of the program to its members. Points could be offered more extensively in the aisles to give the daily shopping experience a “treasure hunt” feel, something that is difficult to replicate online. And, the role of the neighborhood pharmacy as vital to our ongoing health is something that can be communicated and supported through the rewards program.

On this note, much more could be done by both programs to make the reward program a more vital part of the daily shopping experience and remind customers the unique value of a brick and mortar pharmacy. Adding this aspect of value to both programs could prove to be the treatment needed to stave off customer defection to the newest online competitor.

Bill Hanifin is CEO of The Wise Marketer and is a Certified Loyalty Marketing Professional (CLMP).