GRINCH OR CUSTOMER ADVOCATE?

The case against Loyalty Programs1

Consumers love Loyalty Programs, enrolling in many of them in the typical household of most countries. Retailers love them and compete to exceed the number of members in their competitors’ programs while gaining valuable data about the behaviour of their customers. Airlines love them even more as they are so profitable and do not doubt how popular they are with hotels when Hilton can sell $1 billion worth of points to American Express to help make ends meet.

But the esteem is not universal. In the credit card industries, regulators have reduced interchange, the funding source for most card loyalty programs, partly because of the perceived social inequity of cash-paying customers subsidising program members through merchants increasing prices to cover costs. Consumer groups regularly warn customers to not increase their spending above need or pay premium prices in order to ‘earn more points’, disclosing that the rewards are not worth any unnecessary expense.

There are learned individuals in the legal profession who claim there are structural costs and dangers to loyalty programs that should lead markets to favour a ‘No Loyalty’ trading environment.

The Carrot and the Stick

It has always been in the best interest of ‘Suppliers’ to retain customers; to maximise profit & prevent competitors from gaining a foothold in their market. They can do this by ‘punishing’ churn or rewarding loyalty: metaphorically two approaches, the stick and the carrot. Both strategies increase switching costs - when switching costs are sufficiently high that customers stay with a supplier they do not like rather than switch, the customer is the victim of 'lock-in'.

Lock-in from any source discourages new entrants to a market by making it harder to attract customers and it makes customers vulnerable to decaying service levels and rising prices from complacent suppliers.

Lock-in by 'Stick' was common in long term contracts with Early Termination Fees (ETFs). The tactic often included generous ‘tickler’ offers to attract customers, followed by subsequent bill shock as discounts were clawed back.

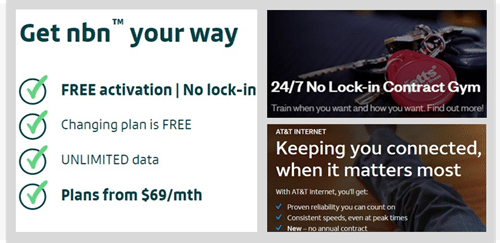

Some credit card balance transfer offers are still like this, with high interest rates on balances after the interest free period. Consumers have learned the dangers of these offers and they have become less common e.g. telco and gym plans are increasingly promoted as 'no lock-in contracts', acknowledging that customers are looking to avoid being hit with ‘the stick’ and there is little doubt that termination fees are seen as penalties and resented.

Regulators in many jurisdictions have limited the size of these fees to prevent them being blatantly used as customer punishment.

These lock-in contracts with ETFs have declined in most markets as customers learned about their downside and actively searched for 'Free Exit' agreements with suppliers. ‘Free Exit’ is a strong benefit for customers as it keeps suppliers focused on maintaining customer satisfaction in order to retain them while allowing innovative new entrants to the market to gain customers.

The “lawyer’s argument” is that in response, suppliers have changed their lock-in strategy to the ‘Carrot’; Loyalty Programs. These erect barriers to customer churn and allow the collection of information that enables smarter marketing while creating a sense of advantage in the customer.

The lock-in of rewards leads to similar results as early termination fees; risk of abuse, softer competition between incumbents & barriers to entry for new competitors2.

They contend that Loyalty Rewards also 'lock-in' customers but their effect is underestimated because it does not seem sensible to be suspicious about a reward, and that they exploit imperfectly rational aspects of the customers’ make up, e.g.;

- Loss aversion – people are more sensitive to losses than gains, so customers do not like foregoing benefits (missing earning points) more than incurring extra costs.

- The points tend to be more appealing than they really are, sometimes becoming an end in themselves in an example of secondary reinforcement (think Pavlov’s bell), creating 'calculative commitment', even a craving, and raising switching costs.

- When a reward is included in the transaction, customers feel a sense of advantage, sometimes maximising the reward rather than the purpose of the transaction

- We know customers spend more / often as they approach a point threshold in what is known as the goal gradient effect

- Suppliers often create a sense of achievement in the collection of points, highlighting progress towards a goal

- Loyalty Rewards leverage feelings of reciprocity that customers feel towards the supplier following a reward. It is quite common for customers to spend more with a supplier after receiving a reward.

- Customers underestimate the costs of redemption, so suppliers get some customer loyalty for free, with some customers never actually claiming rewards

"As long as consumers overestimate the value of rewards - and particularly the value of points - they will not buy from sellers that do not offer rewards.”3

The Rational Customer

Customer learning moved markets away from ‘stick’ agreements and rational customers could move markets away from the 'carrot' of rewards to avoid lock-in. 'If “disloyalty” becomes the virtue consumers appreciate—a freedom to choose the cheapest and most convenient transaction — competitors offering it would flourish. As “No Contract” is crowding out stick-based Lock-in, “No Loyalty” would be joining it in crowding out carrot-based Lock-in.' We doubt this will happen any time soon, human nature being as imperfectly rational as it is. There is some evidence of this in the US credit card market with 60% of affluent Americans preferring cash back rewards.

Cash back is an immediate reward that avoids the irrationality of points, but it is far from being the only reward sought by US card holders;

- 55% of Americans own a reward credit card, with the reward choices

- Cash back 63%

- Points for merchandise 47%

- Airline miles 39%

- Fuel & others 39%

Frequent flyers are overwhelmingly members of multiple programs, because they consider loyalty programs after finding flights that are the best price and most convenient – quite rational behaviour4 .

There are also prominent examples of suppliers who succeed without overt lock-in strategies, apart from great prices, quality and service; Walmart, Apple, USAA…

In Australia we see leading retailers, Aldi, Bunnings, Officeworks without Loyalty Rewards: these companies do not need programs as they have sustainable cost advantages and offer a cheaper price as the loyalty incentive, rather than an accumulated reward. Price is particularly important in high frequency categories like grocery, but less so in others, which explains why apple do not have a program, are relatively expensive but also have high quality products.

It may be that if a supplier cannot differentiate on price or quality, a loyalty program is a way to keep competing? Would there be an Uber Loyalty Program without Lyft, Ola, Didi?

At Ellipsis we are not sure of the merits of this “lawyer's perspective”, nor the costs incurred if it is correct. We do know that customer loyalty should be a primary outcome of any company strategy and that it is foolhardy to have only one initiative in place in attempting to achieve it. Customer demands, competition and markets change so balanced approaches, informed by your customers’ behaviour are critical should you need to pivot to retain their business, with or without a loyalty program.

Ellipsis specialise in Loyalty and Customer Insights. We help our clients become customer centric, because we believe getting this right is crucial to creating value.

Please get in touch, we’d love to talk.

References:

- White paper is based on two articles; Exit from Contract | Journal of Legal Analysis | Oxford Academic 2014 2937230 and The Costs of Loyalty. On Loyalty Rewards and Consumer Welfare | Vasquez Duque | Economic Analysis of Law Review 2017 8593

- Sweden & Norway prohibited Loyalty Rewards for airlines in their domestic markets as they imposed an entry barrier to new airlines competing with the national monopolists. They relaxed the prohibition after new entrants were established

- The Costs of Loyalty. On Loyalty Rewards and Consumer Welfare | Vasquez Duque | Economic Analysis of Law Review 2017 8593

- Air Transportation: A Management Perspective John Wensveen 2015