You may have seen the latest research from PDI covering trends in consumer loyalty across the convenience and fuel retail sector. Their latest report, “Road to Rewards Report 2019”, is worth a read. The survey data reveals consumers changing preferences towards loyalty programs, currencies, and communications challenges, as well as retailers’ challenges and priorities for the coming year.

For those of you who are time-pressed (wait a minute, that’s all of us), we share four key highlights that should spark your curiosity:

1) 50 percent of consumers join a loyalty program to earn points or rewards on everyday purchases, up from 19 percent in 2017

- The ability to earn rewards has a direct impact on frequency; 30 percent of consumers will shop more where they can.

2) Loyalty programs that offer fuel savings are most popular

- 66 percent of consumers belong to loyalty programs offering these rewards, a 12 percent uptick since the 2015 inaugural survey.

3) Mobile’s popularity has doubled in less than five years

- Consumers citing mobile apps as their preferred redemption channel has jumped to 44 percent, more than double the percentage of 2015. In that year, only 20 percent of consumers surveyed said that mobile mattered.

4) Retailers struggle to leverage data

- An overwhelming 75 percent of retailers surveyed collect consumer data from their loyalty programs, yet only one third (34 percent) use the information to attract new customers.

After reading the report, Wise Marketer had a few burning questions which we posed to Brandon Logsdon, President and GM, Marketing Cloud Solutions at PDI Software. Mr. Logsdon’s responses follow, and we are delighted to offer you this added level of insight into the study’s findings. Many thanks to PDI and Mr. Logsdon for his time to provide this information for our readers.

Popularity of fuel savings as a reward

WM: It seems that consumers are maintaining strong interest in earning fuel savings. What do you think drives people to value a fuel discount over other types of rewards?

If consumers were to calculate the value of free merchandise compared to fuel discounts, the "math" might tip in favor of merchandise. That said, fuel always seems to win. What's your take on this phenomenon?

PDI: It’s a good question. First, retail gasoline is the only product that has a price published in 3-foot letters at the corner of “Main and Main” in every U.S. town and city. So, there is a real price awareness factor. Second, and related to the first point, people have very high recall of what they paid for their last gallon of fuel. Yet, if you ask a consumer what they paid for their last loaf of bread or gallon of milk, they struggle to recall.

It’s for these first two reasons, and several others, that consumers have developed a real “sensitivity” to the price of gasoline. It becomes emotional, and the value perception of a discount is therefore very high. It is not uncommon for a customer to choose a 10 cent per gallon discount over $2.00 of “cashback.” Yet that same consumer has a car with an 18-gallon tank! It’s almost as if cents-per-gallon discounts are “math proof”.

Fuel savings and rewards interest across age demographics

WM: It's interesting that interest in fuel savings spans age demographics. Was there any group in the survey that prioritized another reward over fuel?

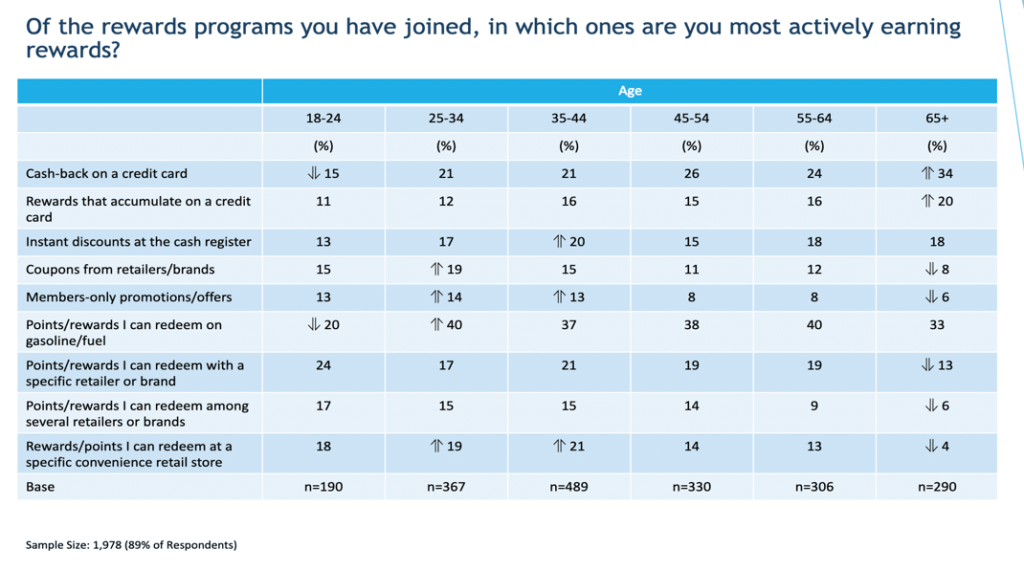

PDI: There is variance across different age demographics.

- 18-24-year-olds are less likely to actively earn to redeem on fuel than other age groups and more likely to earn rewards they can redeem with a specific retailer.

- 25-34-year-olds, on the other hand, are significantly more likely to earn rewards they can redeem on fuel than other age groups, followed by rewards they can redeem at a specific c-store as well as coupons from retailers/brands.

- Other than these two age groups, there is no statistical variance across the different age groups when it comes to fuel savings.

Keys to a successful mobile app

WM: There is no doubt that the mobile channel will be the premier engagement channel in the future. It probably is #1 today. What would you say are the top 3 elements needed for a mobile app to drive value to consumers / program members?

PDI: For a mobile app to be successful, it needs to be very simple and intuitive, or said another way, there shouldn’t be a real learning curve to use it. Secondly, it should be fast and responsive – consumers don’t like to wait for things to load. Thirdly, it should be highly relevant – part of the relevancy is the ability for the mobile app to use geo-services to gain intelligence and only intercept the consumer with a highly personalized and relevant offer.

Proper utilization of consumer data

WM: We just published an article covering loyalty trends for 2020. One trend is related to data and we’d like to know your impressions of the statement, "It turns out that “data is not the ‘new oil’”.

In our opinion, data is not a resource that anyone with the available budget can mine, refine, and market for profit. Data is a valuable, delicate, and sensitive commodity that should be treated with an attitude of stewardship, not ownership. If we ignore this view, we might be abdicating control of customer data to the opinions of regulators and legislators.

PDI: First, that’s a great quote. Having data on the consumer should be treated as a privilege and as something highly valuable that should be properly protected and curated. To the point, there is no sense in collecting consumers' data if you don’t have a) clear need/use for the data, and b) a well-thought-out plan for how you intend to use that data to the consumers benefit.

If you can’t clearly answer (a) AND (b), you might have a real problem on your hands. Furthermore, you probably have bloat and expense in your business that isn’t benefiting your stakeholders.