How Will Marketing Research Evolve?

The pandemic has turned the market research industry on its head. Companies that once depended on in-person interviews and focus groups to gather key insights from their target customers, must now adapt to entirely virtual market research operations.

Forging a new path to entertain the voice of the customer in a world where in-person contacts are problematic is a big challenge, but one that, when answered, will not only provide short term solutions related to the pandemic, but quite likely recast the entire market research industry.

Market research firm Suzy is setting the pace for a new virtual model in market research and we spoke with Avi Savar, Suzy’s President, to learn more about the seismic shifts this year has brought to the industry. To adapt to a new normal, Suzy pivoted to bring its real-time consumer insights platform completely online, providing live trusted feedback from an entirely remote on-demand network of screened and verified consumers.

Here’s the transcript of our recent interview with Avi Savar:

WM: Tell us a little bit about Suzy. Who are you?

Suzy: At Suzy, it’s our mission to put the voice of a brand’s consumer at their fingertips. Whether a novice or an expert researcher, our platform connects companies with the right audience to gather key consumer insights that will help them make better, faster, and more informed decisions. We’ve worked with some of the biggest brands like Chipotle, PepsiCo, Kraft Heinz, AMEX, and Mondelez to deliver breakthrough products and experiences backed by data-driven, consumer-approved decisions.

WM: What is the state of market research today? Is it still effective, even possible, to run focus groups, perform intercept studies, etc.?

Suzy: Today’s market research industry has been severely affected by the COVID-19 pandemic, preventing brands from connecting with their target audiences. With fragmented qualitative and quantitative research tools, it’s becoming increasingly difficult for researchers to apply a mixed method approach to market research. One-on-one interviews with consumers are still important for gathering insights, but these have moved largely to video format.

WM: Are you saying that COVID killed market research as we know it, or was it on the way out before the pandemic?

Suzy: One thing is for certain, COVID-19 made in-person focus groups a thing of the past. Prior to this, 30% of market research was conducted in-person, including exit polling and focus groups. It’s safe to say this part of the market will adapt and transform, and most likely we will no longer rely on some of the more laborious, in-person market research techniques as much as we have in the past.

WM: With that reality in mind, what do you see as the path forward?

Suzy: For the market research industry to stay relevant, it needs to become more agile. Historically, our industry has been very slow moving, but perhaps we will look back at the pandemic as a moment of inflection. With mandated social distancing and gathering restrictions in place, COVID-19 has accelerated digital engagement for market research, filling the gaps in workflows and making systems both adaptable and quick.

WM: The consumer path to purchase is anything but linear. With so many interactions and experiences that happen before a consumer visits a store or website to make a purchase, what should brands know about the way people make purchase decisions today?

Suzy: It’s critical for brands to deliver consumers both speed and connection. With apps and innovation at their fingertips, consumers rely on companies like Amazon to save time and money, making their lives easier. Another example is Zoom, which has enabled us to all work remotely and keeps friends and families virtually connected.

WM: Information related to location, gender, income, etc. may not be enough for companies to truly understand consumer preferences in the future. How will the companies providing third party data need to adjust for the future?

Suzy: The talk of the value of third-party data has existed for years, but the value of first-party data has always been higher for a number of reasons that are relatively obvious. Brands can really level up their creative value when they understand their consumer’s motivations versus only having anonymized third-party aggregated data in hand.

So, assuming that this shift away from third-party data moves to a prioritization of first-party data for brands to access, you'll start to see more contextually relevant offers and creative articulations. Additionally, the level of advertising quality will be elevated. Brands have been taught to rely on third-party data — and it isn’t going away anytime soon — but first-party data will be the driver moving forward.

Additionally, the future is not going to be about quantity, it's going to be about quality. Third-party data has always been about vast volumes of data, in aggregate, to be leveraged and commoditized. That still serves a purpose, but the true value down funnel, once these digital advertising measures are in place, is going to be more about using for enrichment — to improve the quality of other data sets. So, quality will start to become more of a driver than quantity.

WM: In an age where social justice movements are changing consumer sentiment by the minute, how can brands respond to people with more immediacy?

Suzy: It's paramount that brands monitor the constant shifts in consumer sentiment over social justice movements. Brands need to engage and interact with customers swiftly, as consumer behavior over these cultural issues can easily be influenced on other mediums like social media, rather than through the typical news cycle.

It can be hard to know when to speak up and how to strike the right balance, but remember authenticity is key. Be sure to test your messaging with the right audiences, before going out with a public statement. And make sure it comes from a place of sincerity vs. out of the fear of losing customers if you remain silent on an issue.

WM: What social channels (e.g. Twitter, Facebook, Instagram, TikTok) are most effective in understanding consumer preferences? And are they reliable?

Suzy: Social media is not a reflection of reality. It's a reflection of a polarized reality and a reflection of what consumers either want their world to be or feel their world should be. It's not a reflection of what they actually do on a day-to-day basis. So, it's an input that should be monitored and looked at, but it's not an input that brands can make decisions on with confidence.

I think brands can look at different social channels that have a variety of baselines: what videos are trending on TikTok versus what conversations are trending on Twitter versus what's being shared on Facebook. TikTok, Twitter, and Facebook have different behavioral elements and different audiences. There's a herd, or channel mentality that happens on those platforms. Brands should be looking at them, but I think trusting them to be the only input for decision making is a dangerous road.

WM: Do you think brands talk to their customers enough? How can they connect with them more directly?

Suzy: Brands need to facilitate deeper dialogues with their consumers with messaging that resonates. By conducting first-party market research with target audiences, brands can integrate the appropriate voice of their consumer.

WM: What is the point of loyalty and other opt-in programs? Do you think consumers trust opt-in programs and is the information gleaned from these programs helpful/effective?

Suzy: The communications from opt-in programs are definitely more trusted. Establishing a quid pro quo with a consumer is beneficial for brands. An engaged consumer that is respected and valued will give brands their time and truthful thoughts, as opposed to one who thinks that you're just trying to get something out of them or interrupt them from doing what they actually are there to do. So, there's definitely something to be said about the right incentive with the right form of loyalty that equips brands with honest and truthful answers.

The more brands can build direct relationships with consumers, the more honest feedback they'll generate - both positive and negative.

WM: What does Suzy do to help solve the dilemma and shift of an entirely virtual market research industry? Tell us something about your solutions to these issues.

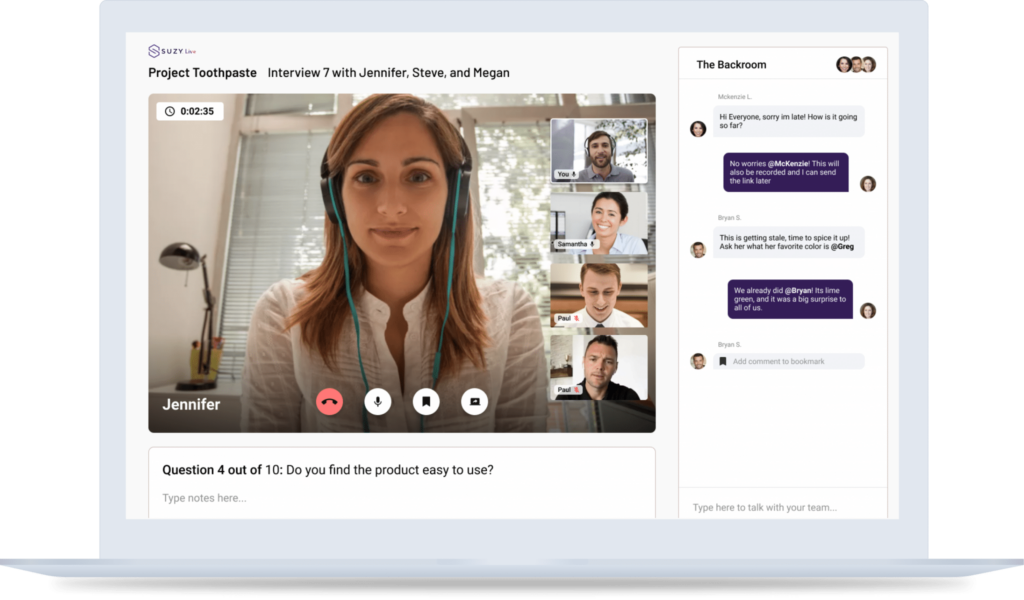

Suzy: In response to market research moving to a virtual world, Suzy recently launched Suzy Live. It’s the first-of-its-kind qualitative research tool using tech-enabled video interviews to capture live consumer sentiment. The Suzy Live solution allows companies to virtually conduct qualitative market research from the comfort of their at-home offices.

With Suzy Live, our team handles all the logistics and makes it easy for brands to conduct interviews remotely and in real time. It's simple, easy-to-use, and cost-effective and offers end-to-end, in-depth interview (IDI) solutions that can truly make an impact.