India is a Rapidly Maturing Market for Customer Loyalty

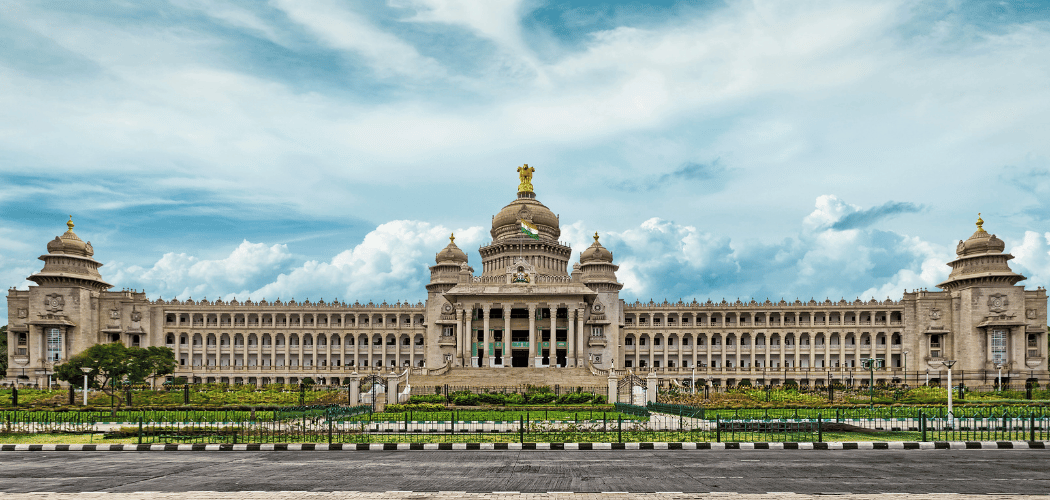

There is a maturity emerging in the loyalty landscape of India. When the top mentioned brands for loyalty in the country are Flipkart and Amazon, with membership bases that cross 100m, it is only natural that the business world stands up and takes notice. We will be discussing this report and more at our upcoming CLMP™ workshop in Bengaluru. If interested, do sign up at https://loyaltyacademy.org/clmp-india/

Customer Loyalty programs have evolved from the just airline FFP’s and hotel frequent guest programs into programs that impact daily living and shopping. They are evolving from simple ‘recognition and rewards for the few high valued customers’ to adding value through additional applications of customer insight, marketing automation and AI, payments, and loyalty currency valuations, providing marketing platforms as well as technology and recognition applications.

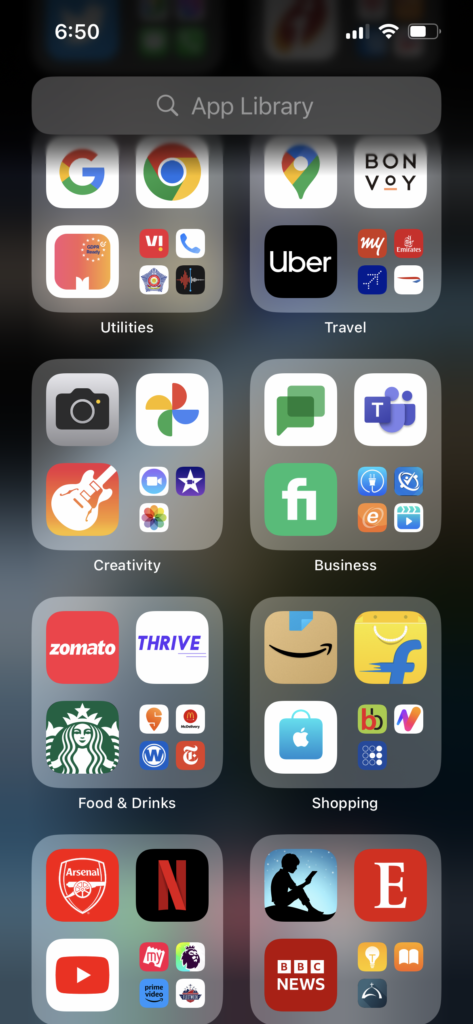

The new loyalty models are being driven by the growths in business, wherein it is common to hear of programs with memberships in the tens of millions. Today there are many brands that reach these numbers, from airline FFP’s, hotel guest programs, credit card, telecom, retail, mobility, food deliveries, F&B, and more. Average memberships of individuals are between 3-5, with high consuming segments even mentioning 7-10 memberships.

It is not a surprise then to see the number of social media discussions and news articles about brands launching their programs and their benefits and features, super apps and loyalty currencies and the discussions reflect the response from customers. It seems that customers have taken well to membership programs and are not afraid to call out programs that suddenly change the point earning equations or put a ceiling on the points they can earn.

New Programs and Brands Highlighted

With the Tata Neu app and Neu coins along with their co-brand with HDFC Bank credit card, Flipkart Plus and Supercoins and their co-brand partnership with Axis Bank credit card, Amazon Prime and their co-brand with ICICI Bank credit card, the number of co-branded credit cards reflect an increasing trend of the loyalty industry growth.

In recent times the sale of the Payback program (now rebranded to Zillion) from ICICI to American Express and now to BharatPe, the global expansion by Capillary and its purchase of Brierley loyalty and other organizations in the US, all point to the excitement in the loyalty space emanating from India.

What are Consumers Thinking?

As we evolve as a country, some interesting insights also surface on the consumer side, from the recently concluded research report in partnership with the Loyalty Lab conducted across the US, UK, Australian and Indian marketplaces some interesting highlights emerge a few of which are mentioned below, and for those interested you can download the whole report here https://strategiccaravan.com/the-future-of-loyalty-report/

- Top mentions of brands that customers are loyal to – Amazon, Flipkart, Zara, DMart and Nike

- In terms of top loyalty program mentions these include Amazon Prime, Flipkart Plus, Reliance One, Zara Club and Intermiles

- The 25-34 years age group reported the most active age group that are loyal

- Indians put the highest weights on personalized experience and value alignment

- Indians (as compared to the other 3 geographies) are also the most concerned about social causes as a factor that connects them to their brands.

This and many many more interesting insights reflect a trend of the Indian loyalty landscape and as we progress to a stage where loyalty programs do not just add value to marketing but become an asset that is valued by organizations.

Summary of Trends

As we evolve some of the implications, we as a country need to watch out for:

- The maturity of the Loyalty industry has increased the complexity of the practice, there is less time for trial and error, and it needs professionals that are formally trained in the business. This will improve the success rate of programs, reduce the number of poorly designed loyalty programs, change their earnings, and value of points and put a cap on points earned on transactions among other loyalty program structural issues.

- Its complexity creates a vast pool expertise requirement from business strategy to data & insights, technology & payments, finance & actuary, rewards & logistics…

- While Indian consumers are quite willing to share data, this will start to decline as customers get weary of the abuse of the data and will increase the need for organizations to build their customer asset (build zero and first- party data) and respect customer privacy

- Privacy rules will increasingly reduce the ability to monetize customer data and the need to build valuable insights will benefit brands that invest in this today

- Brands will need to go beyond transactional loyalty and build strong relationships through value propositions that are meaningful and relevant. This will mean creating a strong social connection, and sustainable marketable models.

- Emergence of social connects will become stronger

- Bio metrics will become the identification mode and Mobiles will become more secure with biometrics and this will become the default identification device.

- As all customer data will begin to be collected, brands will need to discern who their most valuable customers are and prioritize the marketing dollar spends.

- Program will need to create international rewards as memberships go global that make their programs more exciting and relevant, currency exchanges and NFT’s will begin to shape this.

- Coalition models will tend towards Superapps and Market places to adapt to the digital and mobile worlds.

Fun Facts

- Intermiles (Earlier Jet Privilege) is the only frequent Flyer program that outlived the airline and still functions till date

- In a period of 30+ years program memberships have grown 300% + From the Barbie Friends Club (a program we managed in the early days) and memberships that were in the tens of thousands in 1992, loyalty program members now have seen memberships cross 100m in 2023.

Authors Note:

Brian Almeida is a CLMP™ and facilitator for the Loyalty Academy with over 30 years in the loyalty field beginning with the Barbie Friends Club and currently a founder of ‘Points for Good’, a social fund-raising platform that allows members of Loyalty programs across the country to donate their Loyalty points towards a social cause. Along the way he has launched some of the most successful loyalty programs including British Airways Executive Club in South Asia, Jet Privilege (Now Intermiles), Shoppers Stop First Citizen Club, Taj Inner Circle, Bharat Petroleum Petrobonus, Levis, and many more. After running the earliest Loyalty company in India, Direxions (earlier DIREM) and founding Cartesian Consulting – a leading data analytics company, Brian now runs Strategic Caravan International Pvt Ltd that owns and manages the ‘Points for Good’ platform and consults with brands on creating and restructuring path breaking programs.