Charles Ehredt, CEO Currency Alliance, decodes the loyalty platform brain

Editor's Note:

Charles Ehredt, CEO Currency Alliance shares the second of a two-part series on the core microservices that enable loyalty marketing in modern enterprise architectures. The second article is titled the Loyalty Rules Engine - the module that varies pricing and rewards based on the context of the transaction, enabling the types of promotion that are familiar from every major loyalty program. You can find Part one here.

Loyalty rules, and the loyalty rules engine

This piece on the loyalty rules engine is probably the second-most important article I will ever write on loyalty marketing*. It is the most powerful, yet under appreciated module (or tool) in a loyalty marketing stack of software.

The loyalty rules engine is the module that enables the types of promotions that are familiar from every major loyalty program. That includes things such as issuing 2% in points on the customer’s birthday, or double the points value if they redeem on distressed inventory - and varying the points value for a whole range of other contextual reasons related to the purchase. These loyalty rules are created in order to improve customer appeal and profitability, and the job of enabling them in a loyalty program falls to the rules engine.

By contrast: in a simple cashback scheme, you might offer 4% cashback, or in a simple transactional loyalty program, you just offer 1% in points on every purchase. This would not require much of a rules engine – since your program has no variation.

Historically, the rules engine module was embedded in a monolithic loyalty system, and the degree of flexibility in configuring accrual, redemption, or exchange rules depended very much on the technology vendor. Such vendors had very fixed views on how customers should be engaged and rewarded – regardless of how much they knew about the brand’s business, their customer, or their industry.

Brands no longer need to be held hostage by legacy rules engines. Even if you have a rules engine for the majority of existing customer interactions, adding a cloud-based, microservices-oriented loyalty rules engine to your tech stack brings you flexibility. You gain the ability for businesspeople to set additional loyalty rules, regardless of the loyalty platform that you’re using.

This brings significant advantages. The ability to control your loyalty rules in this way greatly reduces your dependency on the IT department or vendors and, importantly, allows you to engage easily with customers across many new sales channels in a consistent way. One might assume that implementing such technology would be complicated or expensive, but a cloud-based loyalty rules engine is really just a thin layer of technology that can sit in front of the primary loyalty system, and can be implemented in days.

An article we published nearly 4 years ago, on why offering 1% of the purchase amount in points is almost always wrong, has become much more popular today than when it was first published. The crux of the argument is that loyal customers are going to make purchases no matter how many points you offer – so routinely receiving 1% becomes boring for the customer, and likely incurs wastage for the brand.

It is precisely the loyalty rules engine that enables loyalty marketers to configure incentives that are timely and meaningful to customers, while driving the desired customer behavior around earning points, exchanging points, or redeeming points.

The purpose of this article is to explain best practices related to loyalty rules, and how to take advantage of the technology enabling these best practices in your loyalty program.

This article on the loyalty rules engine is the second in a two-part series on the core microservices that enable loyalty marketing in modern enterprise architectures. The first article was on the Loyalty Points Bank – which is the ledger that keeps track of loyalty transactions and knows the customer’s points balance.

*The first-most important article I’ve ever written on loyalty is this piece on the importance of partnerships. Nearly every month, it is the most-read article in our blog.

Loyalty rules explained

Loyalty rules are needed because different customer actions are more or less valuable to the business, and different redemptions are more or less profitable. This means that if you can vary the value of an action or price of a reward, you can optimize your loyalty program for greater customer engagement and ROI.

These values can change when they take place in a sequence – i.e., ‘action B’ may be much more profitable if the customer takes ‘action A’ first. So, an effective framework of loyalty rules allows you to attribute different values to different patterns of customer behavior, and influence desirable outcomes much more effectively.

When potential clients contact me saying they would like to create a new loyalty program – but they may not have a great deal of experience, I always suggest that the first thing they do is make a long list of all the behaviors they would like customers to perform. The list needs to be longer than “Buy more stuff”. The idea here is that most businesses probably want to influence 20-40 specific behaviors that either lead to increased sales or greater lifetime value (LTV).

Examples might include:

- join the loyalty program

- complete purchases

- refer friends

- post reviews online

- mention the company in a positive way on social media

- complete surveys

- make a purchase on the member’s birthday

- buy a wider selection of products

- pay on time

- pay with a specific payment method

- shop online

- book in advance

- shop during my slowest period of the week (so we can be more attentive and reduce peak demand)

- spend 20% more than normal

- try a new product or buy a specific product (there could be dozens of this type of rule)

- add a maintenance guarantee or contract

- return unwanted purchases in the most efficient way.

These are just examples. Factors related to specific businesses, such as the profitability of different products or services, or the cost of consuming resources at different times, could lead to a much longer list.

The second step I recommend is that for each of the above behaviors, think about what that action is worth to your business. Is the purchase worth 2% of the incremental revenue or 10% of the incremental margin? Does referring a friend or posting on social media increase the LTV by $25 or $500? Does a subscription to a wellness program mean I will likely triple sales to that customer during the next 6 months?

Nearly everything can have a monetary value assigned to it. This is how you determine what level of incentives to offer the customer to get them to take that action. If the incentives are in the form of points, then you can pretty easily calculate how many points to offer for each action.

The values might be as follows:

| Join the loyalty program | $2.50 |

| Complete purchases | 1% of sales on low margin goods and 2%-5% on high margin goods |

| Refer Friends | $1.00 when referral is made and $5 when the friend makes their first purchase |

| Post reviews online | 50 cents |

| Mention the company in a positive way on social media | 10 cents |

| Complete surveys | $1.50 to $3.00 |

| Make a purchase on the member's birthday | 25% of incremental margin |

| Buy a wider selection of products | 3% of extra items added to basket |

| Pay on time | 1% of invoice amount |

| Pay with a specific payment method | 0.5% of basket amount |

| Add a maintenance guarantee or contract | 5% of the incremental revenue |

If your loyalty rules engine is sufficiently flexible and comprehensive, the assignment of points in this way can be automated.

You also need the freedom to vary these values as needed. Across the list of examples above, few of the behaviors are equally profitable every time or all the time – so the amount offered should vary with the incremental value created. Each action might be worth more or less on Tuesdays compared to Saturdays.

In a points-based program, a base earning amount should be set so customers earn at least an expected amount of value, but you can then introduce bonus rewards to surprise or recognize customers when they take actions that help your business.

As suggested, a business may know that if a customer carries out ‘action A’, they are 80% more likely to carry out ‘action B’. Whereas, if customers don’t carry out ‘action A’, the likelihood they will carry out ‘action B’ is only 10%. Therefore, you might offer fewer points for ‘action B’ and allocate the value associated with ‘action B’ to ‘action A’ – because you want to get the customer on a specific path.

To summarize, the desire or priority to sell specific products or service changes over time, so points-based incentives can be used to create more urgency or motivation among customers if optimized for the specific context of a potential sale. ‘Context’, as described in the next section, is constantly changing, and incentives should change as well to optimize medium-term ROI.

In a program only incentivizing transactions, giving a constant amount of points is nothing more than cashback – and usually less rewarding than the value that disloyal customers can get via third-party cashback or affiliate schemes.

If a brand only offers 1% in points across all products, customers not only come to expect the modest benefit as routine; they also rarely change their behavior to earn more.

Anticipating the context of the transaction

This section will describe the various different types of ‘context’ which you may want to capture with your loyalty rules. Then, we explain the importance of being able to draw on diverse data sources - from elsewhere in your martech stack, and other inputs – in order to vary those rules in real time. This is how you can continually optimize value for the customer, and ROI for the business.

There are three types of context for a transaction which the rules engine ideally needs to be able to factor in:

- the characteristics of the customer

- the characteristics of the product/service

- …and the situation in which the transaction takes place.

The point here (pun intended) is that the ‘context’ of nearly every customer touchpoint is different, and it makes little sense to always offer exactly the same incentive (i.e., 1%).

The context of the customer

This would typically include the customer’s shopping behavior, purchase history, tier status, demographic data, and psychographic insights.

This data is normally stored in the CRM and used to construct customer profiles. The richer the profile, the greater degree of segmentation that is possible, and the easier it is to predict the customer’s response to a given offer. The loyalty rules engine should have access to such insight in order to dynamically adapt the incentive to maximize the probability of driving the desired behavior. With modern systems, that data access is typically provided via an API (application programming interface).

For example, if a customer has not shopped with you for 6-9 months, you might offer a ‘welcome back’ bonus on top of the normal earning rate. A customer who has shopped with you five times this quarter might get a 10% discount coupon for their next purchase.

The context of the product or service

This would include the availability of the inventory, its availability at a specific time, the profit margin on that inventory, and any associated opportunity cost. Opportunity cost includes the lost revenue if the product or service is not sold/booked.

For example, restaurants are often empty on Monday, Tuesday, and Wednesday evenings - but the restaurant still needs to have all the food prepared, staff on hand, and dining environment ready for guests. To optimize the efficient amortization of those direct and indirect costs associated with serving customers, the restaurant will want to attract more customers earlier in the week. Therefore, they might allow customers to redeem points/miles with double the normal value when spent between Monday and Wednesday. They might also offer double points on higher-margin dishes, when one customer pays the tab for the entire table, or if the guests dine outside of peak times.

Similarly, an airline or hotel group might want to offer bonus points to sell seats or rooms that could go empty, or for direct bookings to avoid paying third-party commissions. And, retailers or service organizations will almost always have some excess inventory they want to liquidate, or idle service capacity they want to fill.

The same applies to other forms of ‘distressed inventory’ – i.e., inventory that would forego revenue if not sold, or be discounted in order to sell the goods. Hotel rooms that would go vacant, flowers that will go bad, available taxi ride capacity, or plumbing services capacity that goes unused all fall in this category.

The context of the situation

This includes all other factors that can influence the customer’s predisposition to take an action at a specific time – such as the weather, the time of day, the day of the month, and how convenient it is for the customer to engage via a specific channel or visit a specific store. The majority of customers likely have more discretionary income available right after they receive their salary than later in the month, and they are more optimistic about their future on sunny days.

Loyalty rules can be set to respond to all such triggers in order to maximize the probability of driving a specific customer action. Such personalization has remained elusive in most loyalty programs, but with the right loyalty rules engine, or combination of rules engines, it’s not difficult to tailor engagement in this way.

The reason a modern, SaaS loyalty rules engine is required is that the software needs to be able to accept data inputs from various sources in order to optimize rewards and pricing in response to all the above contextual factors. This is possible with legacy systems, but more complicated, and usually introduces dependencies on the IT department or vendors.

Modern revenue management systems, or experienced team leaders, often know days, weeks or months in advance what portion of their capacity will likely go unconsumed. This insight should be used to inform where to apply incentives, in order to sell more inventory before it becomes distressed. You should also have the ability to vary reward pricing and points value depending on the margin of the goods or services sold, and based on the potential lifetime value of the specific customer, since this will allow you to optimize your loyalty investment based on ROI objectives.

The most sophisticated companies will manage their direct variable marketing costs proactively to optimize ROI across every channel of customer acquisition or retention. The key to considering margins is that when margins are high, investing more in customer acquisition tends to improve ROI. Most enterprises already have the ability to vary pricing in this way for cash transactions. In the domain of loyalty, however, those who are still using legacy loyalty systems, and who are constrained by the legacy rules engine, struggle to do the same with their points value and reward pricing to increase engagement and drive desired behavior. Cloud-based loyalty rules engines overcome such constraints.

Managing the loyalty rules engine

I will now explain the functionality of the loyalty rules engine in more detail, including how it interacts with other systems connected by API – both in your martech stack, and in your partners’ loyalty platforms.

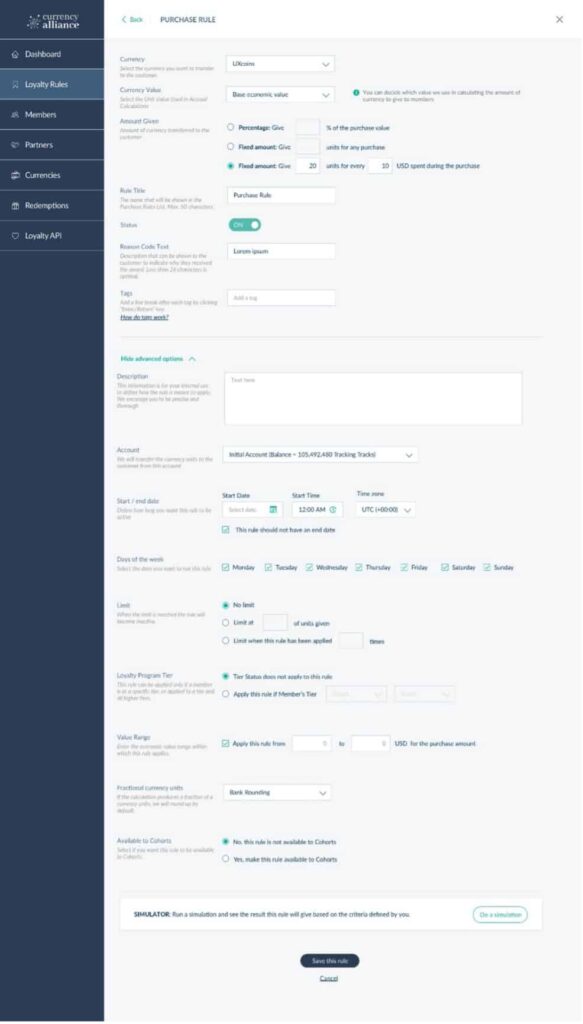

In the Currency Alliance platform, we have rules engines for purchases, non-purchase activities, exchanges and redemptions.

In the screenshot below, you can see that a purchase rule can be associated with your own loyalty points/miles, or can issue the points from popular loyalty programs that your customers may prefer.

Points can be issued based on a percentage of the total purchase amount, a fixed amount of points per purchase, or a number of points per Dollar, Euro, or any other fiat currency spent.

The rule can have a specific or dynamic reference assigned, so the customer knows why they earned these points when looking at their transaction history.

Points can be issued from specific accounts in order to track expenses and improve reporting.

Rules can have start dates and end dates, or even periods of time during specific days when they are activated – in order to run campaigns or drive behavior to reduce peak demand.

Rules can also be defined with limits, with price ranges, for specific customer segments/tiers, or individual products or categories.

Importantly, rules can be layered together to drive very specific customer behavior among segments. For example, a gold tier member that buys a pair of shoes for over $250 at Macy’s could receive 5% of the purchase amount in points, while a silver tier member might only get 2% across all types of shoes. Or, the shoe manufacturer could fund $20 in bonus points when shoes in a specific range are purchased at Macy’s.

In the case of a customer who has been inactive 12 months: you might even offer them twice the incentive as a regular customer, in order to try and reactivate that customer and build new habits.

The activity rules are configured with a similar screen, but rather than incentivizing purchases, activity rules can encourage other types of customer engagements that ideally increase lifetime value. Such activities could include offering points when new members register, giving points for customer referrals, incentivizing positive comments on social media, participating in surveys, posting product reviews online, or virtually anything else that creates a deeper relationship with the customer and/or helps grow the business.

There are often rules that are only applied once a series of events or actions have taken place. These rule processes typically run in batch mode - that could be once per day, once per month, or for any other relevant time period. Such rules include upgrading or downgrading a member’s tier status depending on the level of engagement during the past year. Or, a company might offer a $25 gift card if a customer buys a certain number of items during 3 separate visits to the store.

The interface for business users to configure rules could be as a set of parameters listed top to bottom (as in the previous screenshot) or there could be a graphical user interface that allows you to establish a sequence of triggers for the rule. What is important is that business users can define, test, and implement the rules in a matter of minutes without dependence on the vendor or IT department.

What is perhaps most important is that the loyalty rules engine can operate as a microservice, independent of the points bank, CRM, campaign management, redemption catalog, and customer-facing applications. This allows it to be deployed easily in a broader technical architecture to drive customer engagement across any sales channels, social media, or other customer touchpoints.

When a cloud-based loyalty rules engine is deployed, all the logic is stored on the server side. This means that new rules can be added, rules can be modified, or rules can be removed by businesspeople via a web-based management portal and no new software needs to be rolled out to the POS, website, apps, or other customer-facing platforms. Removing dependency on the IT department or vendors allows the loyalty marketing team to test and learn at a much faster pace, and respond immediately to business opportunities as they arise.

A cloud-based microservice rules engine can also work in unison with an aging loyalty program management system, as a thin layer of technology to enable more flexible operation. As such, the microservices rules engine enables customer touchpoints across any channel, calculates how many points to issue and then injects the correct accrual transaction in the existing loyalty system – so all information ends up in one place.

For all types of rules: the rules engine should ideally have the ability to simulate how the rule will function in a production environment in order to ensure it was configured correctly. A more advanced rules engines might even be able to predict what number of customers will engage with a promotion and estimate the anticipated ROI.

Loyalty rules best practices enabled by modern technology

As mentioned earlier, most companies with a loyalty management system already have a loyalty rules engine embedded in that system. If it is inflexible, then a cloud-based rules engine could run in unison with the existing loyalty rules engine to support customer touchpoints across new channels.

Furthermore, when partners are interested in issuing your loyalty currency to common customers, it will be much easier for those partners to deploy a cloud-based loyalty rules engine than to try and use yours. So, even if a new rules engine is not relevant to your company today, it may be very relevant to your partners so they can also issue your points, or accept them as payment from common customers.

If you do choose to adopt a modern loyalty rules engine you will quickly discover that the possibilities are limitless; an infinite number of rules can be set up to take nearly every variable into consideration. We have found, however, that with 20-30 rules, most situations can be covered. In fact, we have seen that when more than 50 rules are defined, the system starts to become too complex for the loyalty team to manage, and customers start to get confused about what they should do (and when), in order to benefit from the incentives on offer.

Customers rarely think too much about how to earn or redeem points. Incentives that seem easy and logical to a loyalty marketer who is thinking about them 20 hours per week can still seem complicated to a customer that thinks about your loyalty program only a few times per year – and almost never reads your promotional material. So, while complicated rules can be created with ease, our recommendation is to always err on the side of simplicity.

That will make it manageable for your business to navigate the exciting, but possibly daunting possibilities that a modern loyalty rules engine enables. Chiefly, that implies the ability to incentivize desirable customer behaviors across any touchpoint, in any marketing channel or partner environment, and with the ability to precisely predict and improve ROI.

With many legacy loyalty systems, you will only be able to make piecemeal progress towards these objectives by making a custom, often hardcoded integrations to components of your technical architecture. And, you will unlikely be able to use those rules across systems operated by third-party partners, marketplaces, or social media platforms – where you want your brand to be present (but you don’t have control over the systems).

Introducing changes slowly is now simply incompatible with the pace at which your customers travel between digital environments, with the pace of innovation by your competitors, and with the ambitions of most modern loyalty teams.

The only viable way forward is to adopt API-first loyalty technology to give your business the agility it needs to succeed.

Chuck wraps up the discussion describing where the loyalty industry is heading in the next 10 years and explains why an API-first points bank will be needed if brands are to keep up with the major developments and customer trends that are already underway.

You can find the complete article at Currency Alliance here.