New YouGov and Mando-Connect study discovers that the Brits are huge fans of loyalty programmes, but there are significant variations by demographic and sector

YouGov, an international internet-based market research and data analytics firm, and Mando-Connect, a loyalty specialist Partnerships and Rewards Agency, have commissioned the largest ever study into what the British think of loyalty. The study asks YouGov’s 275,000 poll respondents what they want from loyalty programmes, who engages the most, and the impact that offering a programme has on brands.

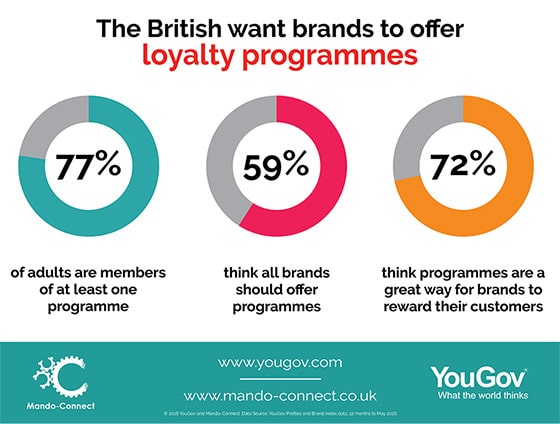

According to the study the British are far bigger fans of loyalty than most brands think. 77% of GB adults are members of at least one programme. 72% think loyalty programmes are a great way for brands and businesses to reward their customers and 59% think all brands should offer a loyalty programme. “This study shows that the loyalty industry in Britain has a huge opportunity to attract, delight, engage and retain customers. The British have very high engagement levels with programmes and strongly desire great programmes from the brands and businesses they admire and shop with” said Charlie Hills, MD & Head of Strategy at Mando-Connect.Interestingly the study highlights huge disparities between demographics and sectors. Demonstrating, there is no single solution to getting loyalty right.

It reveals:

- Women (84%) are far more likely to be members of loyalty programmes than men (70%)

- Membership levels also decrease with age. People aged over 55 (83%) are far more likely to be members of programmes than those aged 18-24 (61%)

The sector also proves an interesting differential. Supermarkets hugely dominate in terms of scale. 65% of GB Adults are members of supermarkets’ loyalty programmes. Tescos is the biggest (65%), followed by: Nectar (58%), The Co-Operative (26%), Morrisons (23%), M&S (19%), Waitrose (18%) and Iceland (16%). The sector will no doubt see the significant movement as huge forces start to impact it this year – from Sainsbury’s acquisition of Nectar, right through to the impending merger of Sainsbury’s and Asda and, of course, the rise of value retailers such as ALDI and LIDL who don’t currently offer loyalty programmes, but might. Not to mention Amazon’s acquisition of Whole Foods which, whilst small in GB, is still significant, especially given the high penetration of Amazon Prime and the rise of Amazon Fresh. An immense change awaits this sector. The study will track membership levels continuously highlighting the direct impacts that industry forces have on these giant programmes.

The study also looked at insights into how programmes can get loyalty right. Revealing that 55% of loyalty programme members want rewards from partner brands, not from the brand offering the programme. In store discounts and offers were the most popular type of reward (87%), and the benefit of being a member of a loyalty programme community was the least motivating (only 6%). Which means that British people are 15 times more likely to want a discount or offer for the benefit of being part of a community. Service-based rewards were also surprisingly undesired; only 18% of people wanted better services from brands as rewards, almost 5 times less than those who wanted discounts or offers. What Brits want from programmes is clear: great rewards, offers and discounts from partner brands.

Loyalty programme membership also has a very positive impact on a brand. When people are members of a loyalty programme they are more loyal, spend more, recommend more and are more emotionally connected to that brand

- 48% say they are more loyal to a brand

- 47% say they spend more with a brand

- 38% say are more likely to recommend a brand

- 28% say they are more emotionally connected to a brand

This research clearly shows that brands should be investing in offering great loyalty programmes and that loyalty, done is right, is a great way for brands to connect to British people’s loyalty, wallets, voices and hearts.

“It’s robust, actionable data like this that enables brands to get loyalty programmes right; to understand what members want and how to engage them in the right way. The variations by demographic and segment that this research highlights are particularly impactful; loyalty programmes should sit up and take note and use the data to find out what their customers and members really want. This study is an important leap forward in understanding the loyalty market in the UK” said Mike Giambattista of The Wise Marketer.

To learn more from the report, you can receive an infographic of key stats and find out how exactly your brand can benefit by clicking here. To download the full whitepaper and find out more about the data set click here.