Rolling Stone writer Matt Taibbi once famously described Goldman Sachs as a “vampire squid” with its tentacles stuck into every nook and cranny of the financial sector. With Amazon rumored to make a major push into advertising-supported content, will we soon be able to use the same descriptor for Jeff Bezos? Stay tuned.

Rolling Stone writer Matt Taibbi once famously described Goldman Sachs as a “vampire squid” with its tentacles stuck into every nook and cranny of the financial sector. With Amazon rumored to make a major push into advertising-supported content, will we soon be able to use the same descriptor for Jeff Bezos? Stay tuned.

By Rick Ferguson

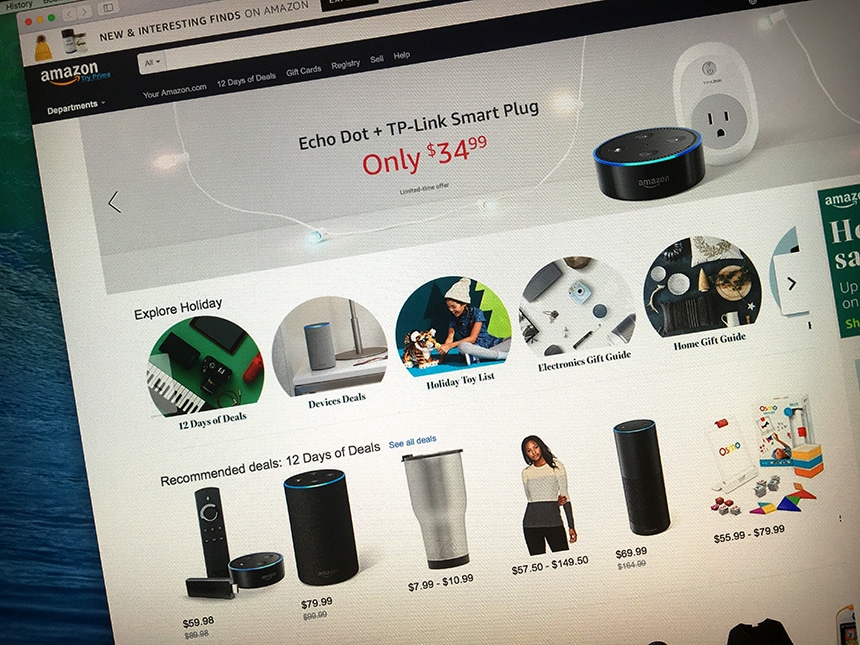

While no one currently thinks of Amazon as a potential competitor to Facebook and Google, which currently make up a combined 63.1 percent of US digital ad spend, according to eMarketer, that’s not because Amazon has not considered itself as such. According to Clarus Commerce, Amazon generated $1.4 billion in ad sales in 2016, and might reach $.2.4 billion this year. Those are teeny-tiny numbers by FaceGoogle standards, but they’re a start—and those numbers are poised to grow.

That’s because Amazon is rumored to be preparing a free, ad-supported version of its Prime Video streaming service, which includes the requisite slate of movies and second-run television shows as well as such original content at “Transparent” and “The Man in the High Castle.” The rumor appears to have originated with this Ad Age article, which cited unnamed sources familiar with the retailer’s plans. Money quote:

“To get its new effort off the ground, Amazon may share both audience information and ad revenue, even linking payments for content to the number of hours people watch it, executives familiar with the conversations say. ‘Amazon is talking about giving content creators their own channels, and sharing ad revenue in exchange for a set number of hours of content each week,’ says one of the executives, speaking on condition of anonymity to discuss a project that Amazon has not announced. ‘Amazon is taking a smart approach,’ one top ad agency executive adds. ‘The only way to strike these deals is to provide a revenue share and share data insights.’”

Several other media outlets picked up on the Ad Age story, which prompted Amazon to issue a rare denial, via a spokeswoman, that it is contemplating a free version of Prime Video. The denial may be definitive, or it may be cover as Amazon engages in the delicate negotiations with content providers that such a service would require. The question begs, why would Amazon be contemplating a free streaming service when Prime Video is one of the key benefits of paying $99 per year for Prime membership? Other than the obvious goal of claiming a slice of the ever-increasing digital ad pie, the play might be Prime membership acquisition. Money quote from Clarus Commerce courtesy of Payments Source:

“In addition to embracing the impact that ad sales could have in their own right, why would Amazon rethink its current streaming video service? We think it goes deeper, just like with Prime Day. We believe this is about Prime Video (and ultimately Prime) member acquisition… Movies and TV shows are a huge driver of Prime joins, so a free version of Prime Video could be the hook that gets more non-members in the door. Once they are in the Prime ecosystem and experience all the benefits, Amazon is probably betting they’ll stay. 91% of members renew for a second year, so we would tend to agree.”

The downside, of course, is that in order to entice advertisers, the famously secretive e-retailer would have to open up its kimono and share data on viewers with advertisers. With even Facebook and Google under increasing pressure to demonstrate the effectiveness of digital ads, Amazon would need to be much more forthcoming and transparent that it has ever had to be—and that transparency may be a bridge too far for the e-retailer. To make such transparency worthwhile—as well as make up for whatever Prime attrition may occur as a result of viewers forgoing paid Prime membership for the free version—Amazon would need to be convinced that it could capture a significant chunk of digital ad spend.

Given the incredibly lucrative relationship machine that is Amazon Prime, we think that’s a tall order. For now, we’ll take Amazon’s denial at face value—at least until the free service pops up online.

Rick Ferguson is Editor in Chief of the Wise Marketer Group and a Certified Loyalty Marketing Professional (CLMP).