With 79% of the world using contactless payments, now’s the time for financial services brands to explore how to build contactless loyalty.

New fintech companies had been slowly eroding the necessity of in-person interactions at banks — but the coronavirus pandemic has put a stop to them almost altogether. Customers can interact with their banks over the phone or online, but it’s harder to delight customers with these interactions.

Instead of simply accepting a decline in customer loyalty, some banks are instead turning to a concept that we call contactless loyalty. It’s what it sounds like — a way to engender loyalty in customers without meeting them face to face. How are financial service brands adding the human element to their contactless experiences?

By: Shelly Photiades

Contactless payments are on the rise

In a recent survey, Mastercard learned that 79% of the world is currently using contactless payments. This means people can purchase something without physically touching technology that doesn’t belong to you. Contactless payments completely remove touchscreens and card readers. This feature also creates paperless receipts, which is one less thing to touch. Some examples include:

- Mobile wallets

- App payments

- Near Field Communication (NFC) with your credit card, a technology that allows devices such as phones and laptops to share data with each other when they’re in close proximity.

Mastercard has reported a 40% increase in contactless payments during the first quarter of 2020, as COVID-19 worsened and people began to think of cash and credit cards as “unclean”. In a poll of 17,000 consumers across 19 countries, the fintech giant learned that consumers perceive contactless payments as “the cleaner way to pay”.

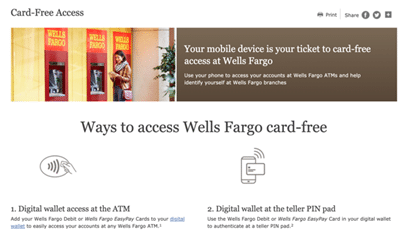

Cardless interactions at the ATM

COVID-19 shutdowns have also contributed to the need for contactless interactions. Closed bank branches made ATMs more important. Some ATMs use NFC to conduct cardless withdrawals and transactions. Similar to card readers, customers can use their digital wallet to conduct the transaction. Another contactless method is for banks to send customers a unique code from their banking app or mobile wallet to enter into the ATM— helpful for on-the-go customers who don’t have their card.

According to Business Insider, contactless ATMs can decrease transaction times from an average of 45 seconds to just 10 seconds. This saves customers time through a safer, simplified experience.

Who’s doing it well?

Chase and Bank of America use mobile wallets such as Apple Pay and Google Pay, whereas Wells Fargo and Capital One have their own apps. Wells Fargo was the first major bank to roll out “cardless” technology across their entire network of 13,000 ATMs. In 2017, they saw digital transactions and ATMs as their top engagement drivers — and now all their ATMs offer cardless transactions.

In the UK, major financial institutions have also established contactless payment methods. Barclay’s “contactless cash” feature allows any customer with an account to make a withdrawal by tapping their card or smartphone on an ATM’s reader.

These brands address customers’ emotional needs around safety, cleanliness and convenience — ultimately developing trust and loyalty.

Build trust and emotional connection through personalization

FSI must make customers feel safe and cared for — and alleviate any doubt they may have around managing their financials.

Brands can achieve this through personalization. When customers open your app, greet them based on the time of day (e.g., “good morning,” “good evening”). A little warmth goes a long way. You can also notify customers of low balances to help them avoid overdrafts and remind them of upcoming credit card due dates to help them avoid late fees.

To take personalization even further, consider each customer’s financial lifecycle and offer them products and services relevant to their life stage. Searching for a new home? Offer them mortgage services. Child nearing driving age? Offer a used car loan. This shows customers you know them and are using their data to best serve them.

Conversational AI and virtual assistants

Consider adding a virtual assistant to your website or app. More than half (56%) of people would rather message a customer service platform than call one, and conversational AI is an always-on service that makes sure these customers get what they need without delay.

While most people are aware that AI isn’t a real person, it still adds a human touch; it demonstrates that your brand wants to provide speedy service. Chatbots and virtual assistants make customers feel less alone as they try to navigate complex and detail-oriented financial apps. Plus, in the future, this technology will be able to read individuals’ emotions to drive ever-more relevant responses.

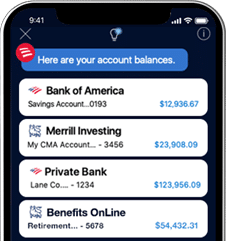

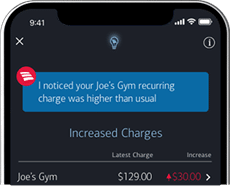

For example, Bank of America’s voice-activated virtual assistant Erica focuses on service and always-on banking capabilities. It monitors transactions and reaches out if it spots unusual activity. With more than ten million users, Erica gives clients greater visibility into their full financial picture.

What’s more, Erica helps provide contextual insights for financial services customers. The assistant can notify customers when they are eligible for BofA’s Preferred Rewards program, notify them when they’re close to the next rewards tiers, and then guides them towards qualification. Over six million clients are now rewards members — people who now have an enhanced relationship with the institution and are that much less likely to churn.

As the world becomes contactless, financial institutions must think beyond technology and identify what they can do to build a trusting and loyal relationship with their customers. Contactless experiences provide a unique opportunity for financial service brands to create emotional connections and address your clients’ concerns around convenience and safety.

Download our e-book on “Contactless Loyalty: Building lasting connections in an increasingly contactless world” to learn more. We define the concept of contactless loyalty, share current consumer trends, and four steps to creating contactless loyalty.

Check out our articles on creating contactless loyalty in other industries:

- 4 Tips for Retailers to Create Contactless Loyalty

- For the Travel Industry, the New Destination is Contactless Loyalty

- How to Deliver Engaging Contactless Experiences While Gaining Guest Affinity

Shelly Photiades is VP, Strategic Services at Epsilon. She is a digital marketing expert who guides leading financial services companies in leveraging marketing technology and data assets to optimize their customer acquisition, engagement, and loyalty programs.