We’re privileged in that we often get an early look at some of the most important research in loyalty - and today’s announcement is another perfect case in point. Today, LoyaltyOne is releasing what they’ve very aptly titled “The Big Picture Report” to media and the business world at large. It’s an ambitious project that uncovers critical insights and trends from 5 key regions around the globe from both a brand and a provider perspective.

Caroline Papadatos, SVP of Global Solutions at LoyaltyOne, spent some time with us discussing some of the broader findings as well as some of the surprises the research uncovered. What follows is an edited version of our conversation with Caroline.

TWM: The scope and breadth of this study are, let’s just say, impressive. Can you talk a little about your decisions to structure the research in this way?

CP: We’re in conversations around the world that are remarkably similar in scope and nature. And we’re asked a lot of questions about how loyalty works – what makes loyalty programs effective – on a local and regional level and, honestly, we needed this research to inform those conversations. We operate in 51 countries and have 26 offices around the world - it’s one thing to speak to loyalty best practices globally but because of the cultural differences, the variations in market maturity and a whole list of other factors, brands and practitioners want to know what works there – where they are. This report is as much an answer for us as it is for our clients around the world.

TWM: There is a lot to digest here and I encourage everyone who is reading this to download the full report for themselves. But as the person who has probably the best view to the broader findings in this research, I’d like to find out, from your perspective, what were the big takeaways? The big surprises? Again, on a high-level basis, what are the key findings that you would like people in the C-suites around the world to see and understand from this report?

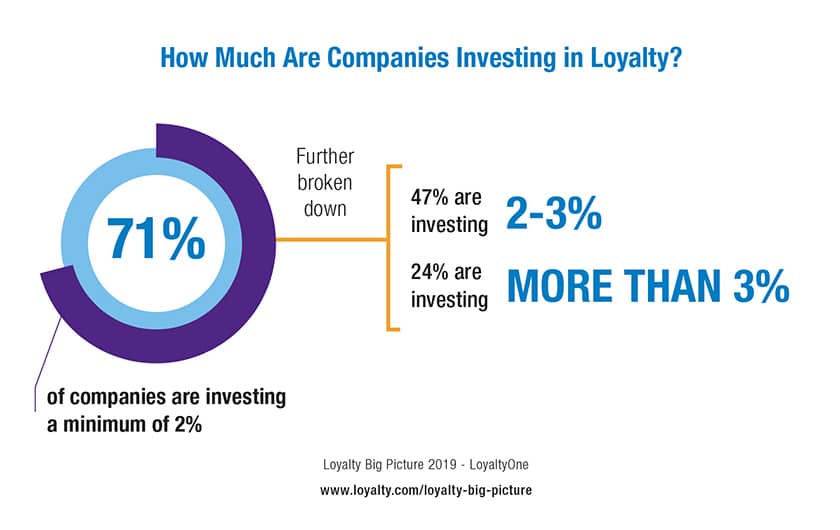

CP: You’re right, there is a lot here. Just to frame this somewhat, we found that, on the low end, companies are spending something like 2% of their total revenue on customer management (customer loyalty & CRM) efforts – and that’s the low end of the spectrum. We found that it’s not uncommon for companies to be spending 4% on up to 7% of revenues on the high end. Once you understand that, you get a sense of how important loyalty programs can be to the overall corporate budget and why it’s so critical that we are able to provide solid, data-based guidance to the C-Suite when we’re asked to. And we’re always being asked.

TWM: I was surprised by several statistics throughout the report but one in particular really struck me. Apparently, only 30% of companies are increasing their investment with an eye to creating more customer value. That is to say, according to your findings, creating more value for the customer is not a very high priority as compared to some other more competition-oriented reasons. In fact, Tad Fordyce, SVP of Loyalty at Epsilon, is quoted as saying that there are many more companies that are competition-centric rather than customer-centric. Can you speak to that? Was your team able to gain any insights into why companies seem to place such a low priority on creating customer value?

CP: That was a surprise for us as well. If you look at some of the other higher priority items, what you see are things that are more empirical in nature. The number one reason why companies have increased their investment in loyalty was that program membership showed growth. That was the top reason given (42% of respondents). What that tells us is that the big KPI’s are important. It also tells us that there is a lot of room to educate C-Suites about the real benefit and value that a well-run loyalty program can deliver.

TWM: One other item that stood out is the overall growth of loyalty – not just of the loyalty industry, but its impact as well. We can see that from where we are but we’ve only been able to speak to that fact anecdotally. In your report, however, you have hard data that proves it. In fact, by some reports it’s growing by 25%. What’s behind this growth?

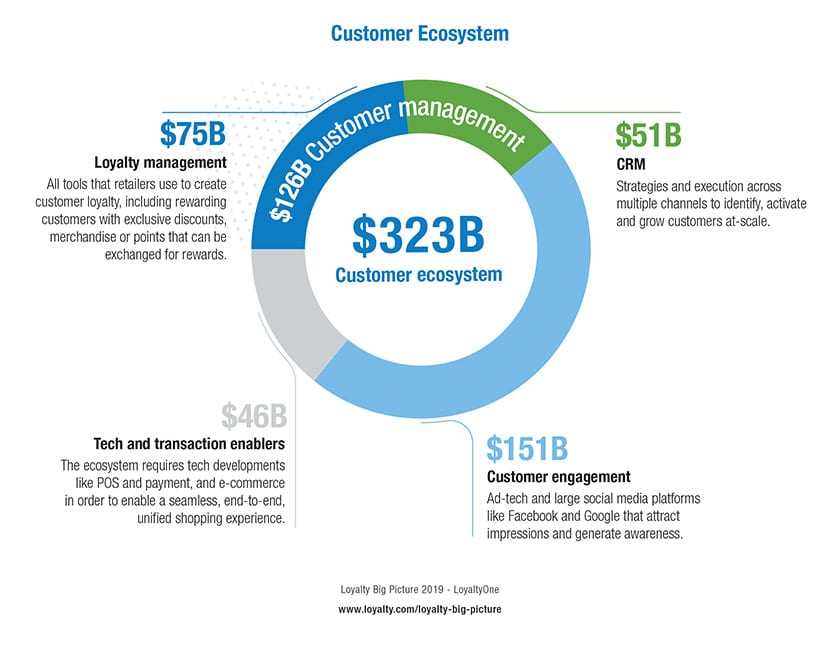

CP: The loyalty world is growing – fast. We found that the total 2019 customer ecosystem is a whopping $323 billion. The growth in loyalty is really coming from 3 different areas. Organic growth of programs, the awareness of the value of program data, and of third, the growth in the sheer numbers of players. All of those are exciting to us but I think the most significant factor is the new-found awareness of what value program data can bring to an organization and how much it can inform other strategies within the company. In other words, loyalty program data is now helping guide everything from product selection and pricing, to marketing campaign decisions to new strategic initiatives. Of course, the loyalty programs themselves are very much about affecting consumer behaviors, but the value of the data derived from them is now becoming much more appreciated.

TWM: I mentioned it earlier but there is a lot to digest here – and it’s not just academic. There are entire sub-sections that provide real, actionable insight for marketers across the spectrum – not just loyalty marketers. I encourage everyone reading this to download the report and distribute it to your teams. There is a lot here.

Beyond that though, what are the big “take-aways”? What would you like brands and program operators to gain from this report – at a high level?

CP: I think that would be to ask themselves if they’re deriving the most value possible from what is evidently a really significant portion of their overall revenue. Loyalty programs are proliferating, competition is only getting more fierce, and most corporations are allocating large chunks of budget to loyalty - and yet many only have a modest understanding of what can be gained. We’ve gotten pretty good at helping brands and program operators understand and build that value.